Risk Management, Internal Audits, And

ISO Standards Services

خدمات

الإستشارات والتدريب

التميٌّز المؤسسي

جائزة قطر للتميز الحكومي ونموذج التميز المؤسسي الأوروبي EFQM

دليل السياسات

يشمل دليل السياسات والإجراءات تصنيف الأقسام والوحدات الإدارية وتحليل العمليات وتوثيقها واعتمادها

التخطيط الإستراتيجي

بناء الخطط الإستراتيجية ومتابعتها وفقا لرؤية قطر الوطنية 2030

التدقيق الداخلي

النتائج والتوصيات وتحليل بهدف تصحيح حالات عدم المطابقة وتحسين الأداء في مختلف الأقسام والإدارات

معايير الأيزو المختلفة

التأهيل لشهادات ضبط الجودة العالمية ايزو ISO وغيرها من المعايير العالمية

إدارة المخاطر

بناء سجل إدارة المخاطر ومعالجتها من خلال نهج مركزي كليّ وليس بشكل مستقل داخل الوحدات

Magnus Management – Quality, Strategy, EFQM Excellence

ماجنس مانجمنت للإستشارات ذ.م.م

عن الشركة؟

ماجنس للإستشارات شركة استشارات إدارية تم تأسيسها عام 2017 في الدوحة - قطر، لتقديم خدمات الإستشارات والتدريب في مجال التخطيط الإستراتيجي والتميز المؤسسي ومعايير الأيزو المختلفة. بالإضافة إلى إدارة المخاطر والتدقيق الداخلي والعديد من الخدمات الإدارية والتطوير المختلفة التي تستهدف مساعدة الشركات في تطوير اعمالها وتبسيطها وتحقيق التميز المؤسسي وفق معايير ومتطلبات توجهات دولة قطر وزيادة فعالية العمليات وزيادة الإنتاجية.

إن السـعي المسـتمر لتطويـر القطـاع الحكومـي فـي دولـة قطـر لمواكبـة التسـارع الـذي يشـهده العالـم فـي المنافسـة علــى التحــول لإقتصــاد المعرفــة يحتــم علــى الجهــات الحكوميــة والخاصة الســير قدمــا لتقديــم خدمــات ذات جــودة عاليــة للمتعامليــن، والعمــل علــى تطويرهــا ورفــع مســتويات كفاءتهــا وفعاليتهــا فــي ظــل تزايــد الطلــب علــى الخدمــات الحكوميــة مــن كافــة شــرائح المجتمــع القطــري واختــلاف احتياجاتهــم وارتفــاع مســتويات توقعاتهــم.

إن الإلتزام بمعايير الأيزو يعني وجود منهجية علمية في عملية اتخاذ القرار وإيجاد ثقافة التحسين المستمر في المؤسسة، الأمر الذي يسهم في تعزيز جودة المنتجات والخدمات من خلال وضع معايير وإرشادات تساعد الشركات على تطبيق ممارسات أفضل في تصميم وتصنيع المنتجات وتقديم الخدمات. وتحسين رضا العملاء من خلال تقديم منتجات ذات جودة مضمونة وخدمات موثوقة وملتزمة بالمعايير الدولية.

Magnus Management – Quality, Strategy, EFQM Excellence

رؤيتنا

أن نسهم في دعم المؤسسات القطرية والعربية وتحقيق الاكتفاء العربي في مجال الإستشارت الإدارية

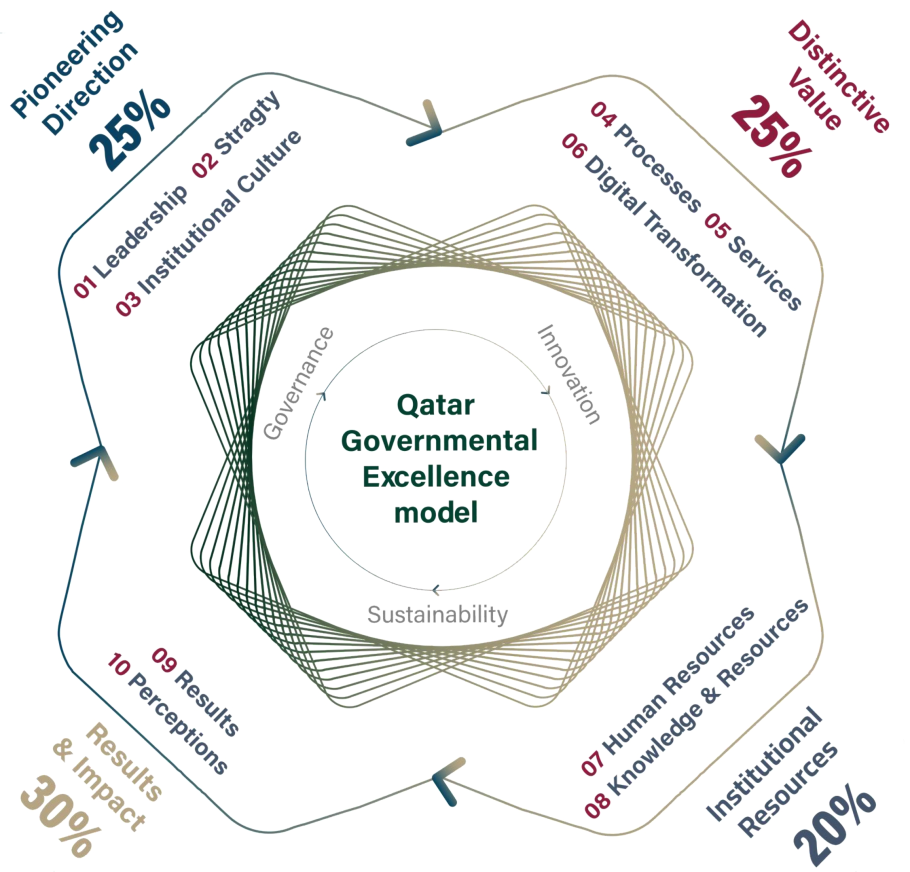

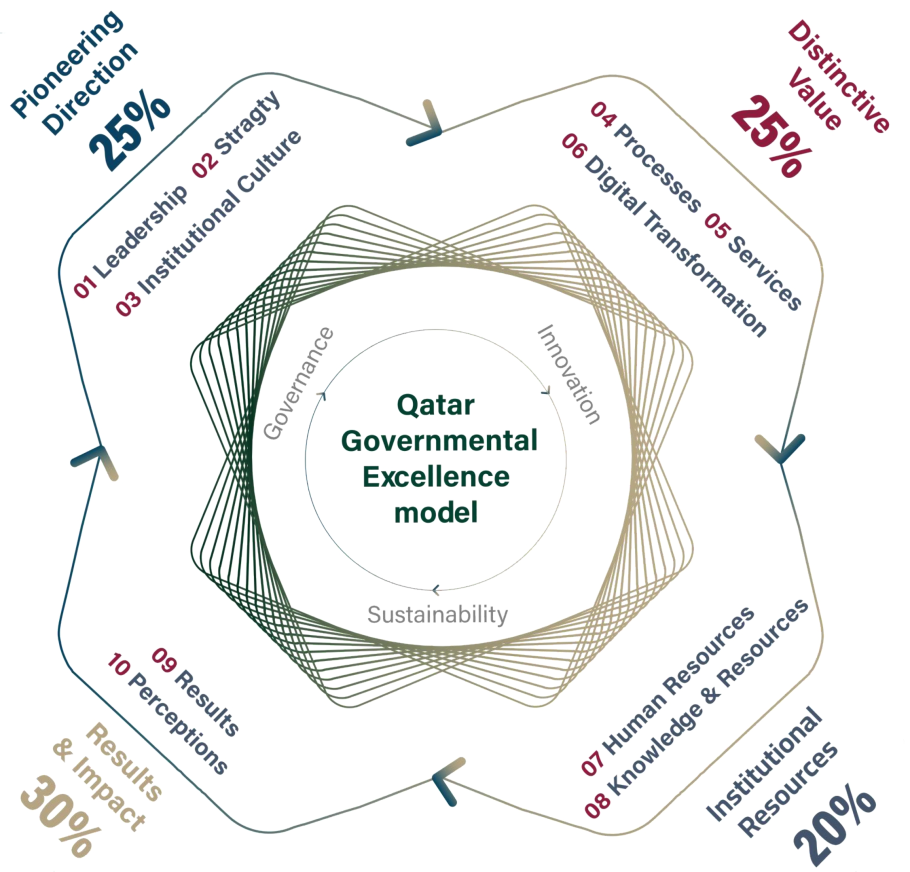

جائزة قطر للتميز الحكومي

أطلقت جائزةُ قطر للتميز الحكومي في أغسطس 2023، وذلك بهدف الارتقاء بمُستوى جودة الأداء الحكوميّ وتشجيع الجهات الحكومية والموظّفين على التنافس في تطبيق الجودة والتطوير والتميز في الأداء، من خلال تكريم الإنجازات والجهود المتميزة لجميع الفئات المساهمة في تحقيق رؤية قطر 2030

التوجه الريادي

القيادة، الإستراتيجية والثقافة المؤسسية

القيمة النوعية

العمليات، الخدمات والتحول الرقمي

الموارد المؤسسية

الموارد البشرية، الموارد والمعرفة

النتائج والأثر

النتائج والانطباعات

معرض صنع في قطر 2023

قامت ماجنس مانجمنت للإستشارات ذ.م.م بعقد ندوة تعريفية عن التميز المؤسسي والجودة وجائزة قطر للتميز الحكومي خلال مشاركتنا في معرض صنع في قطر لعام 2023 في الدوحة تم خلال الندوة عرض محاور جائزة قطر للتميز الحكومي ومعاييرها ومناقشة أهمية الالتزام بمعايير الأيزو العالمية، ومناقشة أهم مواصفات الأيزو التي تتسابق مختلف الشركات للحصول عليها ودورنا في تقديم خدمات الإستشارات والتدريب لتأهيل عملائنا في الامتثال لها وتأهيلهم للحصول على شهادة الأيزو. وتم القيام بمناقشات تعريفية مع الزوار بهدف التوعية بأهمية معايير الأيزو والجودة كمعايير ال ISO 9001:2015 QMS, ISO 14001:2015 EMS,ISO45001:2018 OH&S

شهاداتنا

عملائنا السعداء

سعدنا بالعمل مع العديد من المؤسسات والهيئات الحكومية والخاصة وتقديم خدمات الإستشارات والتدريب في مجال التخطيط الإستراتيجي والتميز المؤسسي ومعايير الأيزو المختلفة. بالإضافة إلى إدارة المخاطر والتدقيق الداخلي والعديد من الخدمات الإدارية والتطوير المختلفة.

خبراتنا

نحن نمتلك

استشاريون معتمدون

مقيم من EFQM

نموذج التميز الأوروبي

المنظمة العالمية للتخطيط الاستراتيجي

الوحيدون في قطر

مدققون معتمدون لأنظمة الأيزو

لأنظمة ISO 9001, ISOO 14001, ISO 45001 & ISO 27001

مستعد؟ أبدأ رحلة تطوير أعمالك

نحن هنا لبدء مشروعك الجديد والانتهاء منه قريبًا